Begin With The End In Mind

Steve Coveys second habit is “Begin with the end in mind” – this means every decision we make in business should be made considering our ultimate exit strategy.

“Begin with the end in mind” – sounds really simple but unfortunately most people lose sight of the strategic management of their business – and this vital habit end sup not being followed by business owners who are so entrenched running their business day to day –they don’t allocate the time and energy to planning and designing the method to help them maximise the value of the business and achieve a successful exit.

This rule simply means that every decision we make in our business can then be mapped back to our exit plan – why are we building this business in the first place –Covey goes on to explain “ if you want to have a successful enterprise, you clearly define what you’re trying to accomplish…. the extent to which you begin with the end in mind often determines whether or not you are able to create a successful enterprise.

”Business owners that are able to focus on building the equity by having an exit strategy mapped out are able to maximise the value of their business and importantly extract that value when they come to exit. In terms of our decision making we can then match every decision we make back to our exit strategy – why is this important – well for example the advice you would get in relation to how best to structure your business would be completely different if you told me that you wanted to pass your business onto your children and retire compared to wanting to list your business on the ASX. The structure cannot be the same for both exit options and therefore how can we provide the correct advice if we don’t know which exit option we are aiming for?

Business owners who have mapped out their exit plan can then make decisions that will get them closer to that plan. If I am going to list my business on a stock exchange it would be great to engage people who have worked for and led successful listed companies – this gives potential investors more comfort and you are therefore more likely to successfully achieve your exit through the listing.

Once we have an exit option we can match every aspect of our business to that exit plan –for example how big does our business need to be to exit successfully – ensuring our business goals match our personal wealth and retirement planning needs. Many businesses grow for growths sake not to deliver a specific target upon exit – I have worked with two clients in the last few months who have simply outgrown the buyers capability to pay for their business and they therefore have large vendor finance arrangements in place – a risky way to secure your retirement wealth!

“Take time to deliberate, but when the time for action has arrived, stop thinking and go in” – Napoleon

Exit options

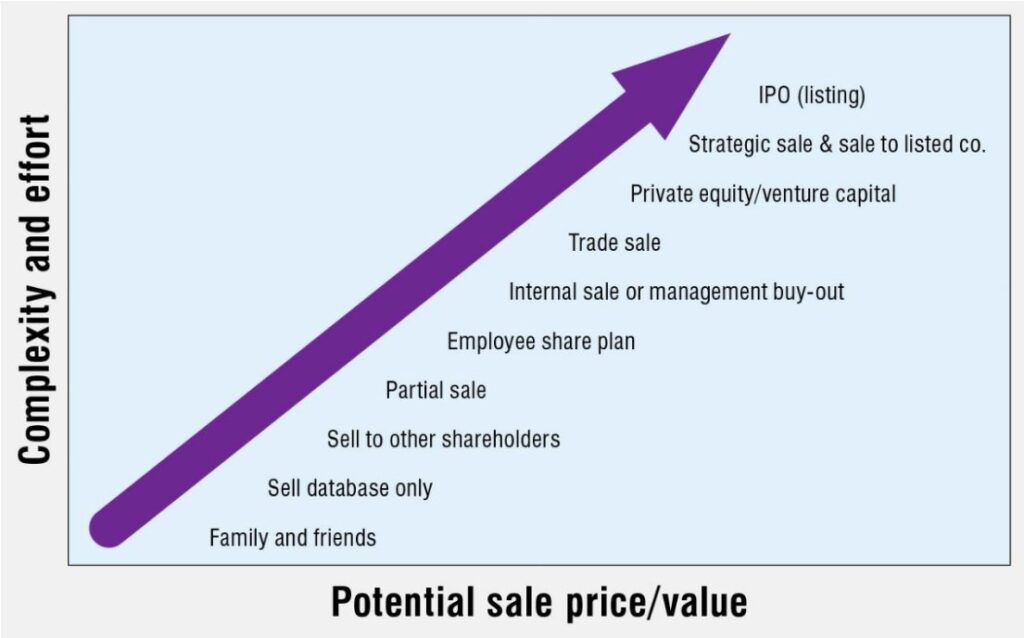

“Begin with the end in mind” means reviewing the various exit options and choosing the most appropriate option for your business:

Importantly, not all options are suitable for all businesses – and even more importantly several of these options can be utilised & combined as part of an overall exit strategy –many businesses successfully raise capital to expand or make an acquisition ,then as the next stage they lock key employees in with an employee share plan ( both de-risking the business by linking the financial performance to key people engaged within and improving performance ) and then go on to find a strategic buyer and sell the business to fund retirement.

Business succession and exit planning is not an outcome or project – it is a process but not beginning with the end in mind is the same as hopping in a taxi at Sydney airport and instructing the driver to just drive around and see what happens. To maximise the value of your business and achieve a successful strategic exit you must “begin with the end in mind.”

This article has been prepared by Nexus Wealth Management Pty Ltd. Any advice in this document is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance or other decision. Please seek personal financial, tax and legal advice prior to acting on this information.